Guide: Choosing the right Single Family Office type

In the next 10 years, an unprecedented shift in wealth will happen as trillions of dollars will move from one generation to the next. Referred to as “The Great Wealth Transfer,” this phenomenon will have a major impact on the way wealth is managed globally. Merrill Lynch research estimates that $84 trillion will change hands by 2045, with Baby Boomers passing on their fortunes to Gen X, Millennials, and even younger generations. Considering that 70% of families lose their wealth by the second generation (G2) and 90% by the third (G3), massive amounts of wealth and numerous assets under control are at risk of disappearing into thin air.

Has anyone among us lived through such a massive transfer? We doubt it. So how have families prepared for this, and with what long-term goal in mind? This question is worth exploring. For Principals—the current holders of wealth and power—a family office (FO) is probably the greatest tool to plan and execute the transmission of assets to the next generation. Its role is to provide a centralized structure for holding and managing family assets, ensuring that financial, legal, and strategic elements are seamlessly coordinated.

Additionally, family offices provide transparency and facilitate alignment among family members, which, as we all know, is the greatest threat to wealth preservation during transition moments. Family life, focused on preserving unity, applies equally to wealth. Unity may seem like a boring concept to many, but it is undisputed that disunity can be extremely costly.

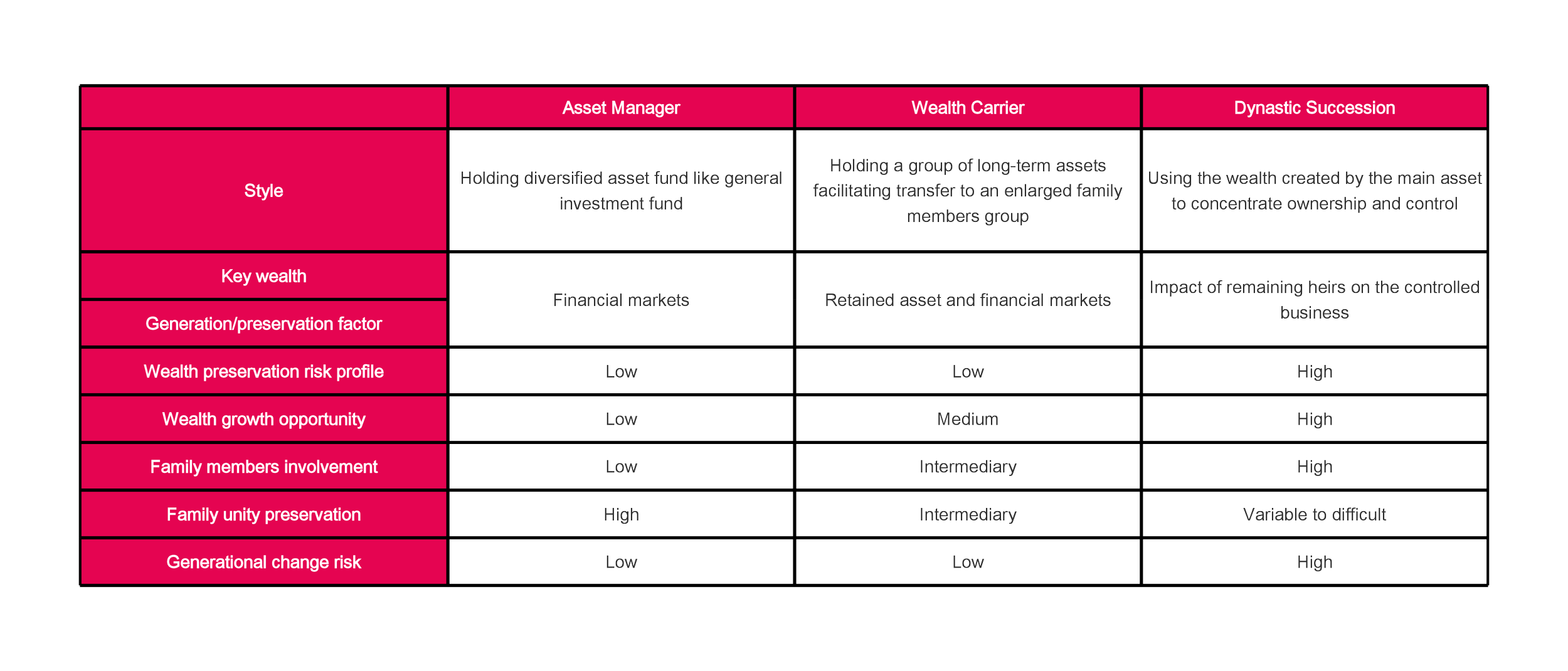

The saying goes, “When you’ve seen one family office, you’ve seen ONE family office.” While they share a common set of characteristics in terms of purpose and modus operandi, a “family office” is not a standardized organizational model. It is a highly customizable entity designed to serve the unique needs of wealthy families or individuals. After analyzing the multitude of frameworks now in existence, we concluded that Principals can (and need to) choose from three main categories for their family office. Their decision typically depends on family dynamics and expectations regarding how the family will remain united—or not—after their passing.

🏦 1. Asset Manager

The goal of this type of FO is to grow the family’s wealth for the benefit of both current and future generations, acting as a traditional collective asset manager. It oversees and manages diversified portfolios aligned with the family’s long-term goals and risk appetite. By recruiting an expert team and centralizing asset management, the family office pools resources to navigate complex financial markets and invest in alternative assets such as private equity, real estate, or art. This approach ensures that assets are professionally managed at minimal cost (the FO costs) while accessing diversification opportunities resulting from the unified pool of assets under management.

In this setup, family members determine the long-term strategy and act as ultimate decision-makers on portfolio allocation, relying on the expertise of a specialized asset management team. Occasionally, a family member may take on a more operational role within the asset management FO. However, such a decision does not (or should not) involve a power transfer component.

🔄 2. Wealth Carrier

This type of family office is primarily dedicated to the transmission of assets that are, at least in part, intended to remain under the family’s control or ownership. This could include the family’s historical company, perhaps one carrying the family’s name, or assets that benefit from direct family involvement in management or oversight. Unlike the asset manager model, this structure focuses not only on regular distributions among heirs but also on maintaining long-term control.

These family offices play a critical role in preserving family operational knowledge and ensuring continuity. Unlike the third model described below, they are not designed to concentrate control in the hands of one family member.

By establishing a clear framework for long-term asset transmission, the FO (and its team) simplifies the operational, tax, financial, and legal challenges that accompany generational transfers. Separating the emotional aspects of succession from the technical management of one or a small group of controlled assets reduces the likelihood of poor or erratic operational management, especially during transition moments.

👑 3. Dynastic Succession

This model emerges when the current Principal(s) want one or a very small group of heirs to retain full ownership of a family business. The Principal(s) aim to keep the dynastic business tightly held, ensuring concentrated power protects what they expect to be a perpetual holding.

Heirs will naturally be divided between those who remain involved and those who exit. The remaining heir(s) are tasked with corporate oversight and the responsibility of extracting sufficient wealth or leveraging dynastic assets to generate distributable wealth. Departing heirs are progressively bought out, initially under the current Principal’s watch and later by the chosen heir(s), based on a fair valuation mechanism designed to ensure equitable compensation for their entitlement.

This process usually takes 10 to 20 years and requires sustained efforts to create wealth separate from the “dynastic asset.” Dynastic succession is not merely about wealth transfer; it involves dividing wealth between passive wealth and controlling ownership.

Since this structure heavily relies on the remaining heirs’ skills and preparation, it is also the riskiest. It demands extensive foresight and decisions that are challenging to revisit a decade later. This approach is rarely, if ever, a late-stage strategy, as it requires a significant reserve of “non-dynastic assets” to be successfully accumulated over time. The more exiting heirs there are, the earlier—and more challenging—the process becomes.

🎯 Conclusion

In summary, deciding at inception—or very soon thereafter—what the key purpose of the FO is regarding transmission is crucial. The three models outlined here may not be exhaustive but cover the vast majority of available options. This critical decision should primarily take into account family dynamics and the ability to remain united when the time for difficult conversations about succession arises.